Giles Conway-Gordon

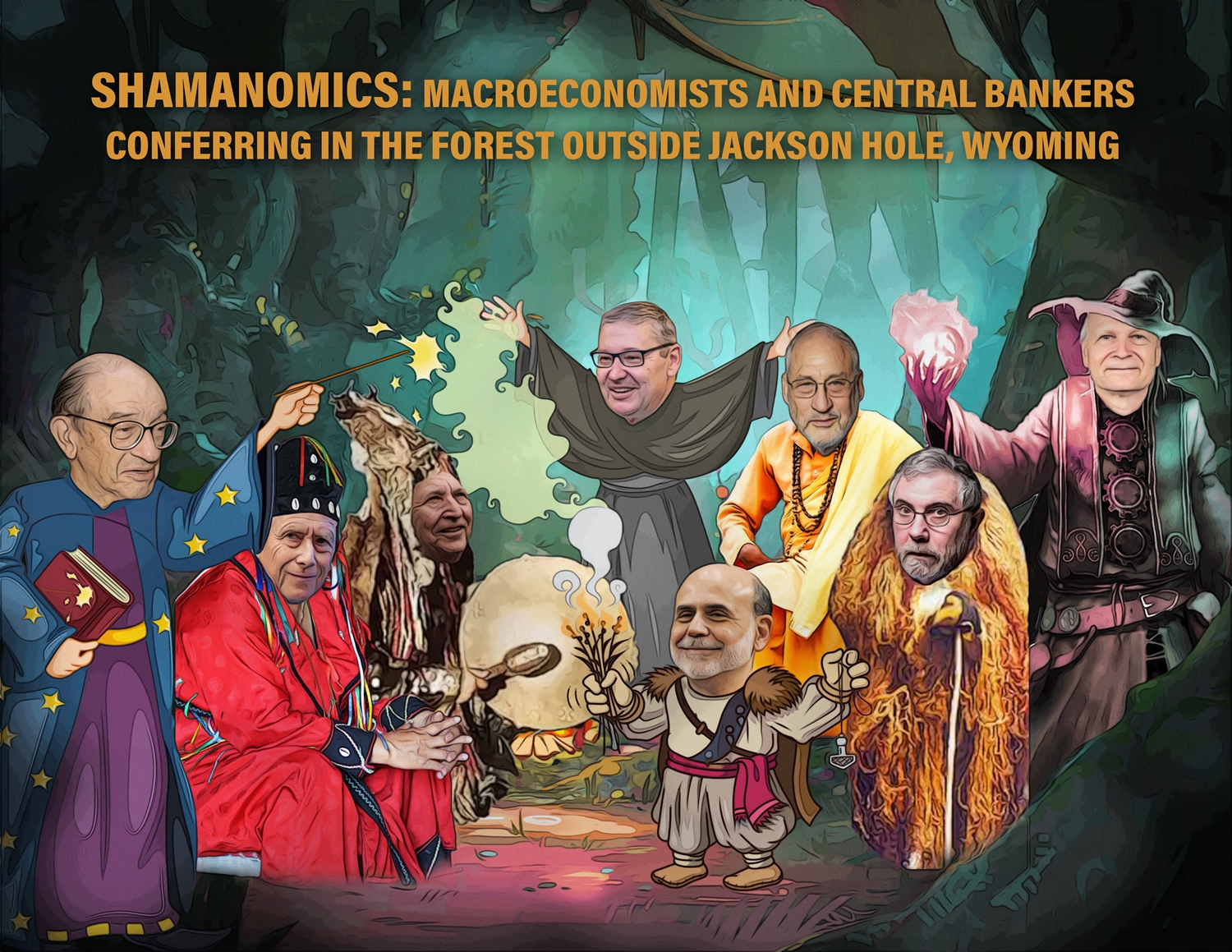

Shamanomics:

Book Highlights

Macroeconomists have failed us. The Crisis of 2008 exposed the flaws in their ‘science’. The fact is that macroeconomic advisers have proven no better than witch-doctors and shamans, uttering their ritualistic mumbo-jumbo and issuing forecasts and policy recommendations based on flawed theories which are not only badly inaccurate and misguided but, as the Crisis showed, very dangerous.

Book Highlights

‘If they are to have a significant policy role in future, macroeconomists will have to discard their preoccupation with irrelevant abstract mathematics and focus on the real welfare of real human beings.’

Chapter One: 1980 – 2008, the Golden Age

Part One: the Golden Age of Growth

This period can now be seen as a Golden Age. The global economy enjoyed sustained growth, with open markets, a steady expansion in world trade and investment flows and low inflation. These economic gains were matched by soaring global financial markets.

Chapter One: 1980 – 2008, the Golden Age

Part Two: The Golden Age of Macroeconomics: We Did It!

It was also a Golden Age for macroeconomists. The long and unprecedented economic expansion and the huge gains in financial markets led to a parallel rise in the influence and prestige of economists, particularly macroeconomists, in the real world of finance ministries and central banks and academia and by extension general public opinion.

Chapter Two: The Crisis of 2008, Causes and Effects

The collapse of Lehman Brothers in September, 2008 triggered a major Crisis in the US and in the entire global economy. Twelve years after the Crisis its effects are still with us, with persistent low growth and high unemployment in many of the developed economies, in spite of massive monetary stimulus by the central banks and an explosion in government debt.

Chapter Three: Whose Fault was It? Who Saw It Coming? We didn’t Do It!

Macroeconomists therefore failed twice: first in not foreseeing the Crisis and taking steps to prevent it and secondly in failing to cure its consequences. These failures exposed the fundamental fallacies in the methods and practice of economics.

This chapter identifies the guilty parties, including Greenspan, Summers and Bernanke, and also the very small number of economists who foresaw the Crisis

Chapter Four: What went wrong? Postmortems

Reviews the critical studies and conferences which have sought to draw lessons from the Crisis for the future of macroeconomics.

Chapter Five: What are Macroeconomists For?

Questions the social use and purpose of macroeconomists and describes the flaws in economic forecasting and the political need for apparent authority.

Chapter Six: Mathematics: Was Keynes a Muggle?

Describes the invasion of Economics by Mathematics and the great macroeconomic confidence trick; also the Economics priesthood, non-mathematical Muggles, University text books and the perpetuation of fallacious theories.

Chapter Seven: Theories, Models and Orthodoxies

Describes the inherent fallacies of the models and methods on which economists base their forecasts and policy recommendations and the dishonest use of elaborate and complex mathematics to appear ‘scientific’. The chapter also describes the pernicious dominance of certain macroeconomic theories as accepted ‘orthodoxies’ and the Fed’s systematic suppression of dissident macroeconomic theories.

Chapter Eight: Multiple Economic Universes, Economics Theories-Of-Everything.

Discusses the multiplicity of conflicting and contradictory macroeconomic theories.

Chapter Nine: Blinded by Non-Science

Disputes the claim that Economics is a ‘hard’ science. The contribution of Behavioral Economics is assessed.

Chapter Ten: The Nobel Prize In Economics: The Pretence of Wisdom

Discusses the unfortunate endorsement effect of the Nobel Economics Prize and notes the minor social significance of most prizewinners’ contributions.

Chapter Eleven: Dentists, Engineers, Plumbers and Novelists

Discusses the various analogies for Economics which have been proposed. Given the infinitely variable nature of economic behavior, economists should more accurately be viewed as novelists.

Chapter Twelve: Where Do We Go from Here?

Looks at the future of macroeconomics after its discrediting and the welcome signs of a much-needed return to a concern with the real welfare of real human beings.

Conclusion

Macroeconomists have perpetrated a massive confidence trick. The 2008 Crisis and its aftermath have demonstrated that they are no better than shamans – primitive witch-doctors, pretending to wisdom and expertise which they clearly don’t have.

The key lesson of the failure of macroeconomics is that the blind faith placed by governments and voters in the flawed theories of macroeconomic advisers should be abandoned forthwith.